OverExpressed

OverExpressedPosts Tagged ‘Personal finance’

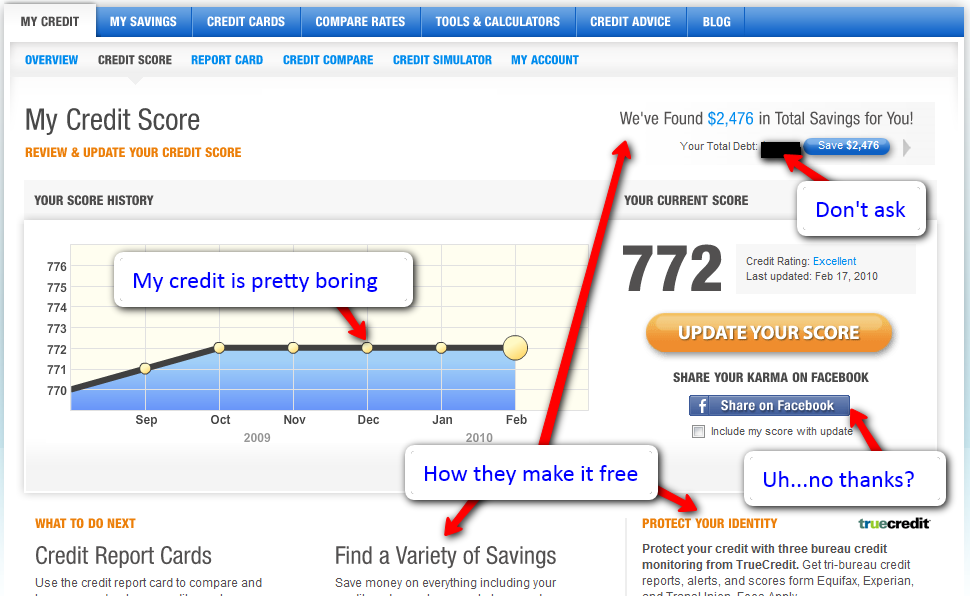

Track your credit score for free with CreditKarma

People seem to think credit scores are really important. I guess I haven’t really seen the value so much as a grad student who isn’t taking out any mortgages, though it probably had an impact on my auto loan a few years back. But I trust the finance people, it’s probably something to be concerned about when it comes to borrowing money for a car, a house, or a bikini. But really, I just like metrics of any kind, so of course I became interested in credit reports.

People seem to think credit scores are really important. I guess I haven’t really seen the value so much as a grad student who isn’t taking out any mortgages, though it probably had an impact on my auto loan a few years back. But I trust the finance people, it’s probably something to be concerned about when it comes to borrowing money for a car, a house, or a bikini. But really, I just like metrics of any kind, so of course I became interested in credit reports.

Prior to discovering CreditKarma, I used to get 3 free credit reports a year using annualcreditreport.com (note: don’t fall for the catchy jingles, freecreditreport.com is a scam). The basic idea is that each of the 3 major US credit reporting agencies is required by law to provide you with one free credit report a year, so I just made a note on my calendar to check a specific agency every 4 months. But this doesn’t give your actual credit score, just a report of your current number of accounts and a history of bad things you may have done. You usually have to pay some extra fee to get the score, unless you want to play a game of chicken with cancellation deadlines (which I’ve done before). But I’m done with all that now that I’ve found CreditKarma.

CreditKarma is free and it’s pretty awesome

CreditKarma is sort of like a Mint for your credit score. You have to enter your credentials once (name, address, social security number), and then they’ll track your score on a monthly basis (but they’ll also check it instantly at any point that you want). It’s important to note that these aren’t “hard” credit inquiries, so they don’t hurt your score. It’s also important to note that a lot of people are afraid of identity theft and martians and other crazy stuff, but the company seems pretty reliable to me.

Beyond quantifying your fiscal dependability in a single number, CreditKarma also provides some nice reports breaking down the individual areas that contribute to that score. They give you a letter grade and a percentile ranking relative to the rest of the herd, helping point you in the right direction to bring that score up to par. On top of that, you can run a “credit simulation” to predict how your credit would change based on a range of choices (paying off your loan, getting a new credit card, selling your soul, etc.). Ok, maybe not that last one. Anyway, all of this is pretty nice, with the only real catch being the targeted offers they show you. Fortunately, there aren’t any annoying pop-up ads, so it doesn’t really hurt the site’s credibility much…which I guess is good for a credit scoring site.

Continue Reading | 10 Comments

Tags: Credit, Credit Score, CreditKarma, Finance, Money, Personal finance, stuff-i-use

Manage your money with Mint

I’m a firm believer in metrics. I love tools that help you measure and track things as easily and accurately as possible. This is probably one reason why I’m so interested in inexpensive diagnostics – to enable regular measurement of physiological changes. But today I want to talk about measuring money.

I’m a firm believer in metrics. I love tools that help you measure and track things as easily and accurately as possible. This is probably one reason why I’m so interested in inexpensive diagnostics – to enable regular measurement of physiological changes. But today I want to talk about measuring money.

People have tried preparing budgets and tracking spending all kinds of ways, ranging from simple spreadsheets to institution-specific tools to expensive software. There are at least three big issues with these solutions:

- Too much effort | You really just don’t have the time to manually enter all of your purchases, and to update budgets and goals in a manual fashion over time. At best you start off sticking to it but gradually slack off and give up.

- Not enough metrics | These methods generally aren’t very good for organizing purchases and making sure you’re sticking with goals for specific spending categories. This is critical for sifting through the junk to get relevant information.

- Too isolated | These tools tend to sit in a box somewhere. Most likely on your hard drive, though maybe in the cloud if you’re using Google Docs. You would really want something that you could access anywhere, and that could send you relevant notifications related to your spending and upcoming bills.

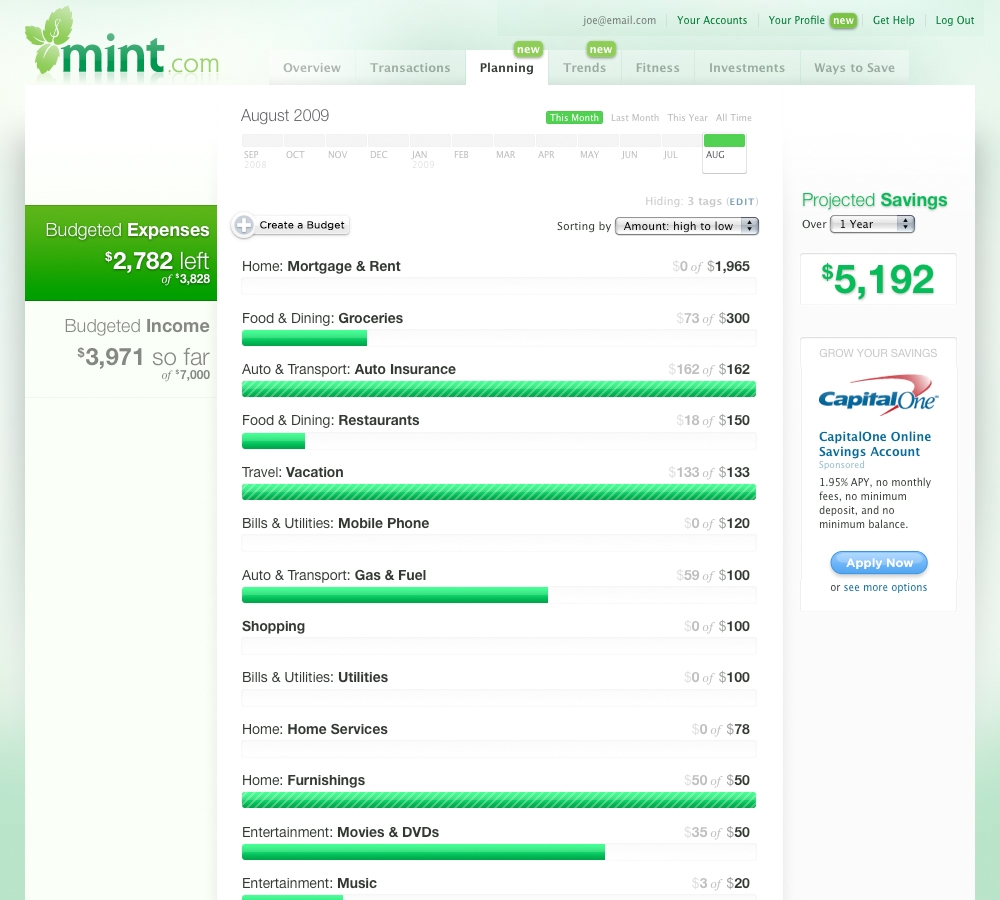

This is where Mint comes in. I’ve been using it for almost 3 years now (since they started their beta back in the summer of 2007), and I’ve been thoroughly impressed with the features and reliability they offer for tracking your finances. All you do is input the login information you use for each of your online accounts and Mint will automatically import and categorize all of your monthly data in a clean and intuitive interface. Here are some of the best features:

- It puts everything in one place | No more searching for specific purchases on a clunky bank website only to find you can’t actually see more than the past 6 months. Mint keeps all of your transaction histories in one place, with simple search and auto-tagging. It’s really amazing how comprehensive it is. I’ve got bank accounts, credit cards, student loans, and an auto loan all in there. If you happen to have a positive net worth, you can even track all those investments you have.

- It’s automatic | Mint is generally about 90% accurate in categorizing my transactions, making it really simple for me to get a quick look at exactly how much I spend on any particular category in a given time period (for example, how much was spent on fast food over the past year).

- It keeps you in the know | The primary concern I hear is mistrust in a startup to hold their financial information. However, I think Mint increases your security by notifying you of anything fishy going on in your finances. You can set all kinds of alerts based on spending and account balance thresholds, and Mint will let you know by SMS or email if anything unusual happens (still waiting for an Android app, though).

- It helps you budget | The budgeting tools help you keep track of your spending during the month, notifying you if money is disappearing faster than it should. This has helped me scale back spending when necessary.

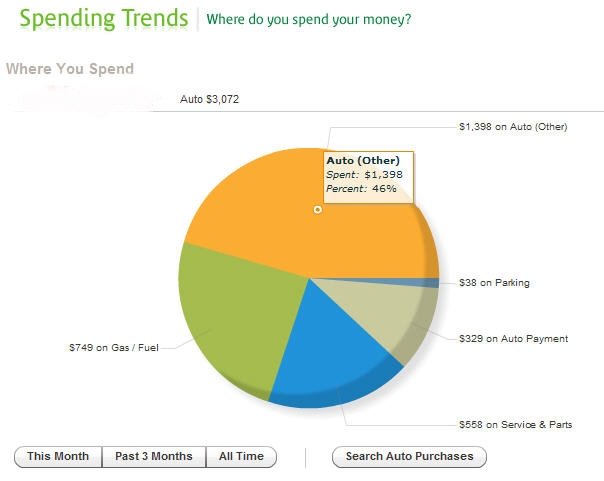

- It identifies trends | Mint offers some very appealing charts to help visualize your spending by category. This way you can tighten your spending a little in areas that are hurting you most. It also helped me identify a relatively small, but regularly recurring, withdrawal from my account that should have been canceled. I was able to immediately contact the offending company and straighten things out.

For those of you who are concerned about leaving all your financial information in the hands of a startup, it should comfort you a little to know that they’ve been secure for the past 3 years of operation, and were even recently acquired by Intuit, a well-established financial software company. There are tons of reasons to love Mint, and it still surprises me how many of my friends haven’t even heard of it yet. Now you don’t have ignorance as an excuse. Go sign up!

Tags: Bank account, Finances, Intuit, Mint, Money, Personal finance, stuff-i-use